Knowing Your “Vitals”

Aug 14, 2025

Essential Numbers Every Business Owner Should Know

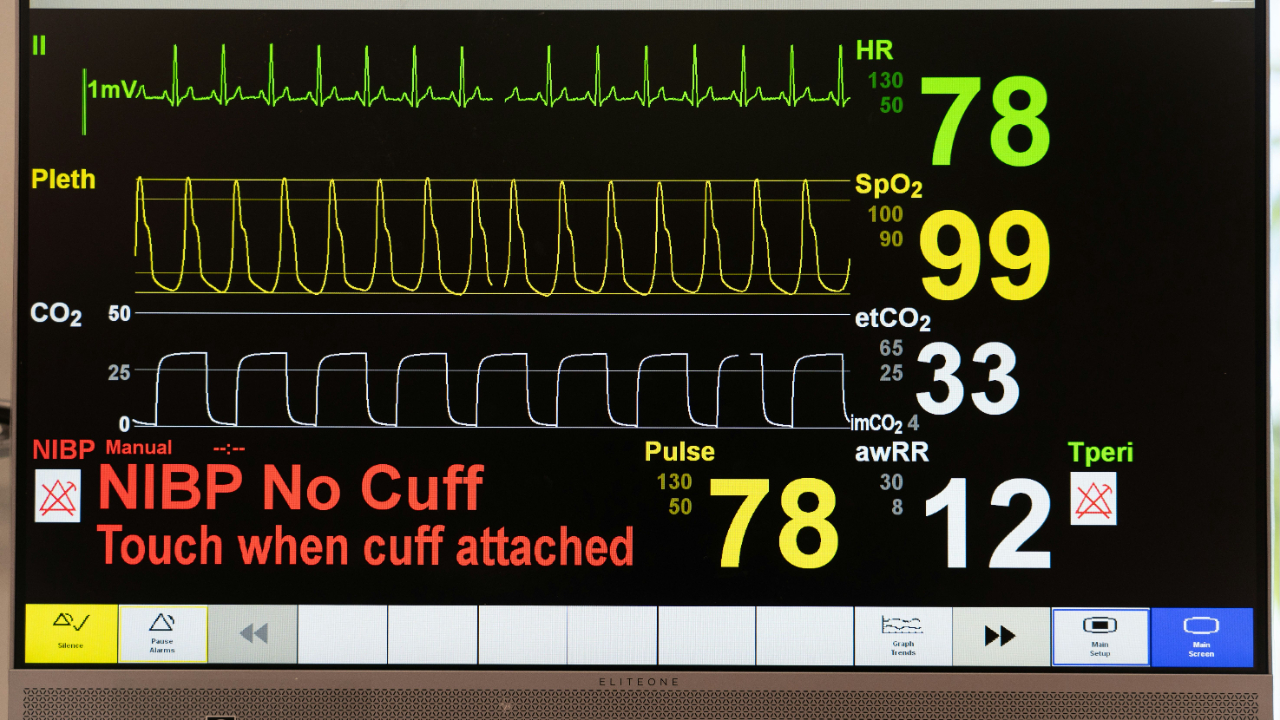

Just as you visit your doctor for a physical exam to monitor your health vitals “heart rate, blood pressure, oxygen levels, etc.”, as a business owner, it’s equally important to regularly check the vital signs of your business. These key metrics give you insights into how well your business is functioning and whether it’s on track for sustainable growth. We’ll break down the most important business vitals that you should be monitoring regularly to keep your company healthy and thriving—and we’ll highlight what constitutes a "healthy" or "normal" range for each metric.

- Gross Profit Margin (GPM)

Your Gross Profit Margin is one of the first metrics you should track, as it provides insight into the basic financial health of your business. This metric shows how efficiently you are producing and selling goods or services, without considering operating costs like rent or salaries.

Formula:

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue

Normal Range:

A healthy gross profit margin typically ranges between 40% and 60%, though it can vary by industry. For example, technology or software companies may have a higher margin, while industries like retail may have lower margins due to higher operational costs.

Why it matters:

Tracking your gross profit margin helps ensure that your business can cover its basic costs and still generate a profit. A low GPM could indicate high production costs or ineffective pricing strategies, while an excessively high margin could suggest missed opportunities for growth.

- Net Profit Margin

The Net Profit Margin is a more comprehensive metric, reflecting your overall profitability after accounting for all expenses—operating costs, taxes, and interest. This is the true bottom line, as it tells you how much profit you retain for every dollar of revenue.

Formula:

Net Profit Margin = Net Income / Revenue

Normal Range:

A healthy net profit margin is typically around 10% to 20%, depending on the industry. High-margin industries, such as software or financial services, can achieve higher net profit margins, while businesses in highly competitive fields with low pricing flexibility, like retail or food services, may have lower margins.

Why it matters:

A healthy net profit margin shows that your business is generating profit after all expenses. If this number is too low, it may indicate inefficiencies or poor cost control, while too high a margin might indicate underinvestment in areas that could fuel growth.

- Current Ratio

The Current Ratio measures your business's ability to cover its short-term liabilities (debts and other obligations) with its short-term assets (like cash, receivables, and inventory). This is a key indicator of liquidity and financial stability.

Formula:

Current Ratio = Current Assets / Current Liabilities

Normal Range:

A healthy current ratio typically falls between 1.5 and 3.0. A ratio below 1 indicates that the business may struggle to meet short-term obligations, while a ratio above 3 could suggest that your business is holding too much cash or inventory, which could be better invested or used for growth.

Why it matters:

A balanced current ratio ensures that your business can cover short-term debts while still having enough assets available for daily operations. If it’s too low, it can lead to liquidity problems, and if it’s too high, you may be wasting opportunities for growth.

- Working Capital

Working Capital is the capital available to fund day-to-day operations. It’s the difference between your current assets and current liabilities. This metric tells you how much money you have to keep the business running without needing additional financing.

Formula:

Working Capital = Current Assets - Current Liabilities

Normal Range:

While the ideal range for working capital can vary depending on the industry, a positive working capital (meaning current assets exceed current liabilities) is essential. In general, having between $10,000 and $100,000 of working capital (depending on your business size) is considered healthy.

Why it matters:

If your working capital is too low, it could mean you are at risk of running out of cash to meet day-to-day expenses. On the flip side, excessive working capital could suggest that your business is not utilizing its assets as effectively as possible, potentially leading to missed growth opportunities.

- Debt to Equity Ratio

The Debt to Equity Ratio measures your company’s financial leverage by comparing its total debt to its equity. This ratio indicates how much debt your business is using to finance its operations relative to the value of its equity.

Formula:

Debt to Equity Ratio = Total Debt / Shareholder’s Equity

Normal Range:

A healthy debt-to-equity ratio typically ranges from 0.5 to 1.5. A ratio of 1 means that your business has equal amounts of debt and equity, while a ratio higher than 1 suggests that your business is more heavily reliant on debt, which could increase financial risk. Conversely, a very low ratio might indicate that your business is under-leveraged and potentially missing out on opportunities to grow.

Why it matters:

A balanced debt-to-equity ratio helps ensure that your business has the right mix of debt and equity financing. A high ratio can increase your risk exposure, while a low ratio might indicate missed opportunities for funding growth and expansion.

- Inventory Turnover

Inventory Turnover measures how quickly your business is selling its inventory. A high inventory turnover ratio indicates strong sales and efficient inventory management, while a low turnover could suggest that you have excess stock or slow sales.

Formula:

Inventory Turnover = Cost of Goods Sold / Average Inventory

Normal Range:

A healthy inventory turnover ratio is typically between 4 and 6, but this can vary depending on the type of products you sell. Retail businesses often have a higher turnover, while businesses with high-end or long-sales-cycle products might have lower ratios.

Why it matters:

Tracking inventory turnover helps you understand whether your stock is moving at an efficient pace. Too high a turnover can lead to stock shortages, while too low may indicate poor sales or overstocking. Both extremes can hurt your cash flow and overall profitability.

- Return on Assets (ROA)

Return on Assets (ROA) tells you how efficiently your business is using its assets to generate profit. A higher ROA means you’re generating more profit per dollar of assets.

Formula:

ROA = Net Income / Total Assets

Normal Range:

A healthy ROA is typically around 5% to 10%. This figure can vary depending on the asset-heavy nature of your industry. For example, capital-intensive industries like manufacturing may have lower ROA, while service-based businesses with fewer assets may enjoy a higher return.

Why it matters:

ROA helps you determine whether you’re making the best use of your assets. A low ROA can indicate inefficiency or excess capacity in your business, while a high ROA signals that you are effectively utilizing your resources to generate profit.

Keep Your Business in Check

Just as your health depends on a variety of factors—from blood pressure to heart rate—your business’s health hinges on these key metrics. By regularly tracking your business vitals such as gross profit margin, net profit margin, current ratio, working capital, debt-to-equity ratio, inventory turnover, and return on assets, you’ll have a clear picture of your financial health and can make informed decisions that drive success.

Key takeaways:

- Regularly monitor these metrics to stay on top of your business's financial health.

- Knowing what’s "normal" or healthy in your industry helps you understand when you’re on track and when you need to make adjustments.

- If any of these metrics are off, take proactive steps to correct them before they impact your growth.

At Thrive Business Consulting, we specialize in helping small business owners improve their financial health and profitability. Let's work together to monitor your business vitals and keep your business strong and thriving!